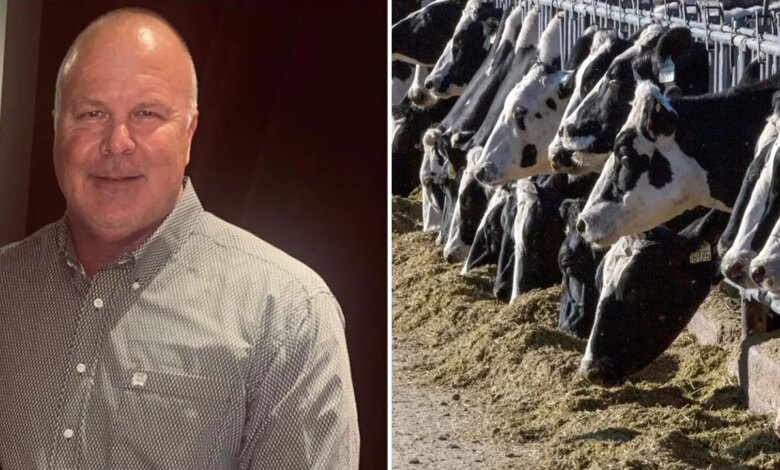

Victims of ‘Bernie Madoff of cows’ take on major banks in massive ghost cattle Ponzi scheme

NEWYou can now listen to Fox News articles!

Victims of a deceased financier known as the “Bernie Madoff of cows” are suing three banks, alleging they enabled the fraud that resulted in a $100 million Ponzi scheme.

Some of those duped by Brian McClain, of Benton, Kentucky, filed a lawsuit against Community Financial Services Bank, Rabo AgriFinance and Mechanics Bank, alleging the institutions ignored red flags that left dozens of Kentucky investors with financial losses, the New York Post reported.

The fraud was uncovered days after McClain killed himself at age 52 on April 18, 2023. He initially promised 30% returns to investors while orchestrating a “ghost cattle” scheme in which the livestock never actually existed, authorities said.

GEORGIA MAN ACCUSED BY SEC OF PERPETRATING PONZI SCHEME SAYS HE TAKES ‘FULL RESPONSIBILITY’ FOR HIS ACTIONS

In a statement to Fox News Digital, CFSB said it was aware of claims to associate our institution with an alleged Ponzi scheme involving another financial entity and its client. We want to be clear that CFSB has no involvement in this matter.”

“CFSB strongly denies the allegations in question, and believes the claims against the bank to be entirely without merit,” the bank said in a statement to The Post. “The bank through counsel has filed a Motion to Dismiss in the suit brought by the bankruptcy trustee.”

“Any suggestion to the contrary is factually inaccurate and legally baseless. Our bank has acted in accordance with all applicable laws and regulations, carrying out its responsibilities as a regulated financial institution,” the bank said. “CFSB has cooperated fully with all relevant authorities and investigations and will continue to do so. We are confident that the facts will speak for themselves and confirm that CFSB has conducted itself with integrity throughout.”

A spokesperson for Rabo AgriFinance told Fox News Digital that the courts will have the ultimate say.

“Rabo AgriFinance remains strongly committed to providing financial solutions to U.S. cattle producers, feedlots, and processors,” a statement from the bank reads. “As stated in prior court filings, the claims have no basis under the law, and many of the allegations are completely inaccurate. As the legal process unfolds Rabo AgriFinance will refrain from commenting further.”

NFL FIRST-ROUND DRAFT PICK FALLS VICTIM TO CUNNING BANK IMPERSONATION SCAM THAT COST HIM THOUSANDS

McClain’s scheme collapsed when Rabo AgriFinance, McClain’s primary lender, discovered a massive discrepancy in inventory, the newspaper reported.

During an audit, only 10,000 cattle were found, far less than the 88,000 McClain claimed to have.

While McClain claimed to have 88,000 head of cattle, only about 10,000 were found during an audit, exposing the bulk of the herd as “ghost cattle.”

After McClain’s death last year, representatives from Rabo AgriFinance seized the remaining cattle from McClain’s operation and sold them through Blue Grass Stockyards.

Three of McClain’s companies — McClain Farms in Benton, Kentucky; 7M Cattle Feeders in Hereford, Texas; and McClain Feed Yard in Friona, Texas — filed for bankruptcy in 2023.

The unpaid livestock sellers could be protected under the Packers and Stockyards Act of 1921, which requires that all livestock purchased by a dealer in cash sales, along with any receivables or proceeds from those livestock, be held in trust for the benefit of unpaid sellers, according to the Department of Agriculture.

McClain’s moniker is named after Bernie Madoff, the former Nasdaq chairman who masterminded the largest Ponzi scheme in U.S. history by defrauding thousands of investors.

Madoff died in 2021 at the age of 81 while serving a 150-year sentence at the federal medical care center in a North Carolina federal prison.

Read the full article here